Cardpay's Alice Duckworth talks about the future of Payments in 2020 and what it means for the Forex industry.

The Forex industry is characteristically fast-moving and turbulent, no matter where a user sits within the ecosystem. On a typical day in Forex, we see the movement of more than $6.6trillion thanks to the efforts of over 9.6 million traders. With all of this momentum and activity, there are plenty of opportunities for payments to take the industry further.

We are already seeing these opportunities coming to the fore in 2020 with the beginning, peak, and end of Covid-19. During these fraught months of the pandemic, the economic consequences of lockdown placed a considerable strain on the market, hitting currency pairings hard, especially as stocks, oil, and gold underwent dramatic fluctuations. But even in this uncertainty, we see a renewed and heightened level of interest in Forex trading and positive trends to look forward to in the aftermath and 'new normal.'

Whether it's through the steady introduction of rapidly emerging markets, the dramatic growth of mobile trading, to the continued rise of the retail trader, the Forex industry of tomorrow is poised to be faster-moving and more exciting than ever. And throughout this formative year, payments represent an open door to this future. Payment solutions remain a vital component of a Forex broker's strategy for success. A highly secure, payments agnostic service is the dividing line between letting traders pay and trade the way they want, and finding another platform that does.

The Rise of the Retail Trader

Traditionally speaking, the Forex market has always consisted of a large proportion of transnational banks and businesses. This majority share also means that the kind of activities taking place on the market veered more towards large-scale swaps and transactions. As a result, any activity taking place between large-scale players in the market would have their own ways of paying, and their own transaction rates.

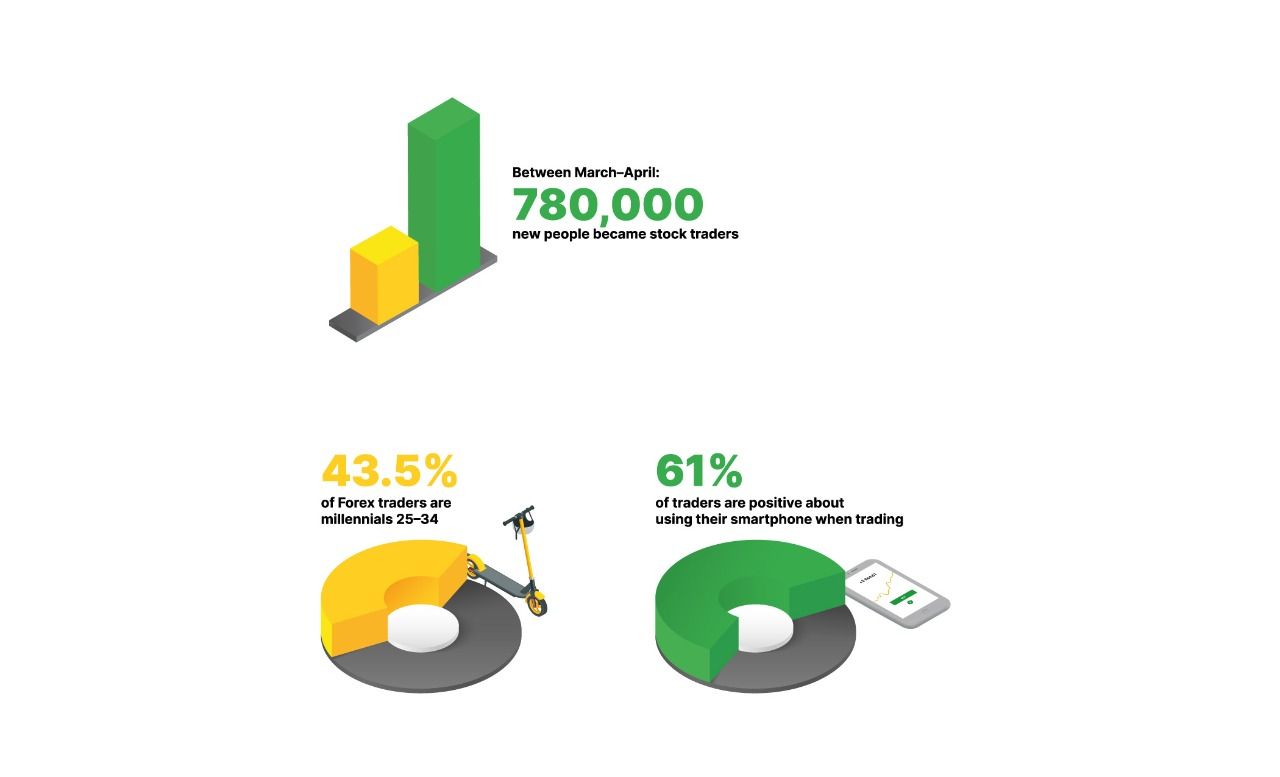

With the economic uncertainties of COVID-19, people have been more intrigued at the prospect of turning a profit by establishing themselves as retail traders, with 780,000 people joining brokers like Charles Schwab, ETrade, and Interactive Brokers over the short window of March-April.

This is rapid growth that is taking place globally as well. Thanks to the expansion of internet and smartphone access, we're seeing retail traders emerging anywhere from Europe and America to Asia, Latin/Central America, to Africa, the latter of which now boasts the fourth largest population of Forex traders.

While institutional traders have their set-piece ways of conducting trades and making transactions, retail traders present a very different, two-fold challenge for brokers.

The first of these stems from the fact that retail traders will behave in a very different manner to large-scale ones. Consequently, this means that the way they engage with brokers will be entirely different; this is where trading platforms need to make themselves more accessible. Platforms like SaxoBank, TD Ameritrade, and CityIndex have been doing just that—making themselves more accessible with training materials, user support, flexible payment methods, and bespoke accounts.

The second challenge lies in payments. Judging from the growth in transaction rates from countries like Vietnam, Thailand, and Singapore, retail traders are making transactions more frequently and depositing more often. As a result of this, every payment they make will incur a commission fee that will be the difference between retaining these traders and losing them to a competitor.

It's inevitable that, throughout 2020/21, as internet and smartphone penetration continues to grow, the number of retail traders will too. As a result, brokers need to be able to approach these same users with as much opportunity and accessibility as possible, whether that through providing competitive rates on transactions or widening the scope for the payment methods retail traders use.

It's in looking at the global growth in retail trading that we can understand how a more payment agnostic approach could serve to widen the doors to this dynamically moving industry. The most successful brokers and payment providers are the ones that are reticent to the needs of the retail trader, providing competitive commissions, global market access, as well as access to locally accepted payment methods, to cut the friction out of the equation.

Forex - Going Mobile

Looking over at the world of eCommerce, more broadly, the continued expansion of internet access has a continuous game-changer for businesses and individuals worldwide. More significant still is the potential that smartphone access represents globally, but also for the Forex industry.

Over the last couple of years, traders and brokers have been warming to the use of smartphones in Forex. One survey in 2018, for example, showed that 61% of traders were generally positive about using their smartphone as a primary medium of trade.

This slow shift over to mobile brings understandable challenges to a market that is otherwise highly regulated, and reliant on the reliable. The Forex industry has always had a precarious relationship with regulatory compliance, making any mobile adoption trickier than just adding them.

The Forex industry and smartphone developers are fully aware of this, with new phones featuring facial and biometric recognition as standard, while the former moves towards broker-agnostic mobile apps. While mobile use in Forex isn't a brand new trend, we see it far more in 2020, and we can expect even more to proceed to 2021.

Mobile-based traders represent a growing, soon to be the dominant segment of the Forex market. For example, studies in 2018/19 demonstrated that 43.5% of the Forex market was made up of millennial-aged traders (25-34). Far from being a fringe segment, it's a demographic that's only going to keep growing over 2020 and beyond thanks to smartphone penetration across the globe.

This is especially true in regions like Latin America and Asia, with countries like China, India, Brazil, and Mexico boasting tens, even hundreds of millions of smartphone users. While these countries lead the way by sheer numbers, the percentage of people using a smartphone ranges from 25.3% (India) to 59.9% (China), meaning that there's plenty of room for growth.

While massive markets, these are countries and continents that are only beginning to plug themselves into both the digital marketplace, as a whole, but also the Forex industry by association. Consequently, we will be seeing millions more enter as traders over the coming years, with payment methods being one of the big reasons for how they can take part.

Author: Alice Duckworth, Head of Partnerships @ Cardpay