Financial technology powers financial services across Asian markets and continues to expand rapidly. This growing trend of scalable fintech is all thanks to startups, brokers, and banks,which collectively help serve billions of consumers. This article explores many of the qualities that the best brokers must have to succeed.

Asia by the numbers

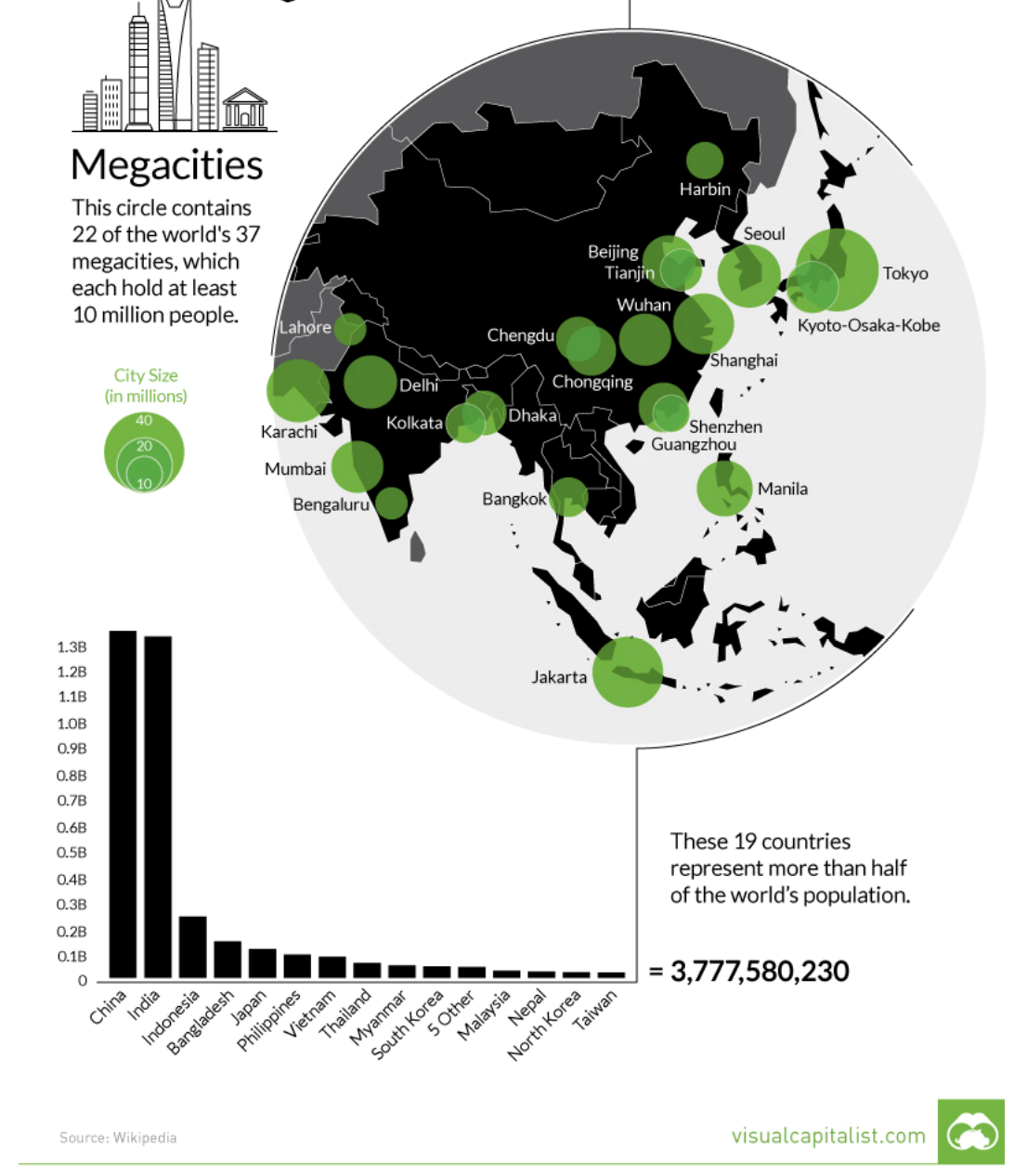

The Valeriepieris circle is an area drawn on the world map representing a diameter of 4000 km in Asia, which contains more than half of the world’s entire population and is right in the heart of Southeast Asia

Recent FX Volumes

Significant foreign currencies are connecting this hub like the Chinese Yuan, Renminbi, Japanese Yen, Malaysian Ringgit, Thai Bhat, Singapore Dollar, and Indonesian Rupiah, among other countries around the ASEAN economies.

· Mainland China rose to be the eighth largest FX trading hub, according to the latest Triennial Survey of Central Banks from BIS (2019), and many other Asia-Pacific currencies saw similar increases in trading volumes, compared to the prior 2016 report.

These major, and emerging currency pairs, help to facilitate local and international trade, for both macro and micro-economies throughout Asia and are interconnected to the rest of the world economy, making Asia an attractive destination for many brokers.

Location: Macau as an example in Asia

Macau is an example financial centre that continues to see growth as an emerging hub, with nearly 20 million arrivals at its airport in 2019 alone, and with billions of dollars spent at its betting venues as its gaming industry grows.

· According to the latest statistics report (2018 data) from the Macau Government, gaming continues to be on the rise since 2012 in Macau, representing 49.1% of the country’s producer price index (PPI).

· The$21.5 billion Macanese Patacas (MOP)from the banking sector is overshadowed by MOP 195 Billion (2018) from the casino and gaming industry, the latter of which grew at a rate of 16% year-over-year.

· With Macao recognized in March 2019 as a tax jurisdiction by the E.U., it has risen as an attractive destination for foreign investors who are considering doing business in one of China's hottest Special Administrative Republics.

The best brokers in Asia pay attention to market trends to follow the growth and economic environments where they have an interest in operating in.

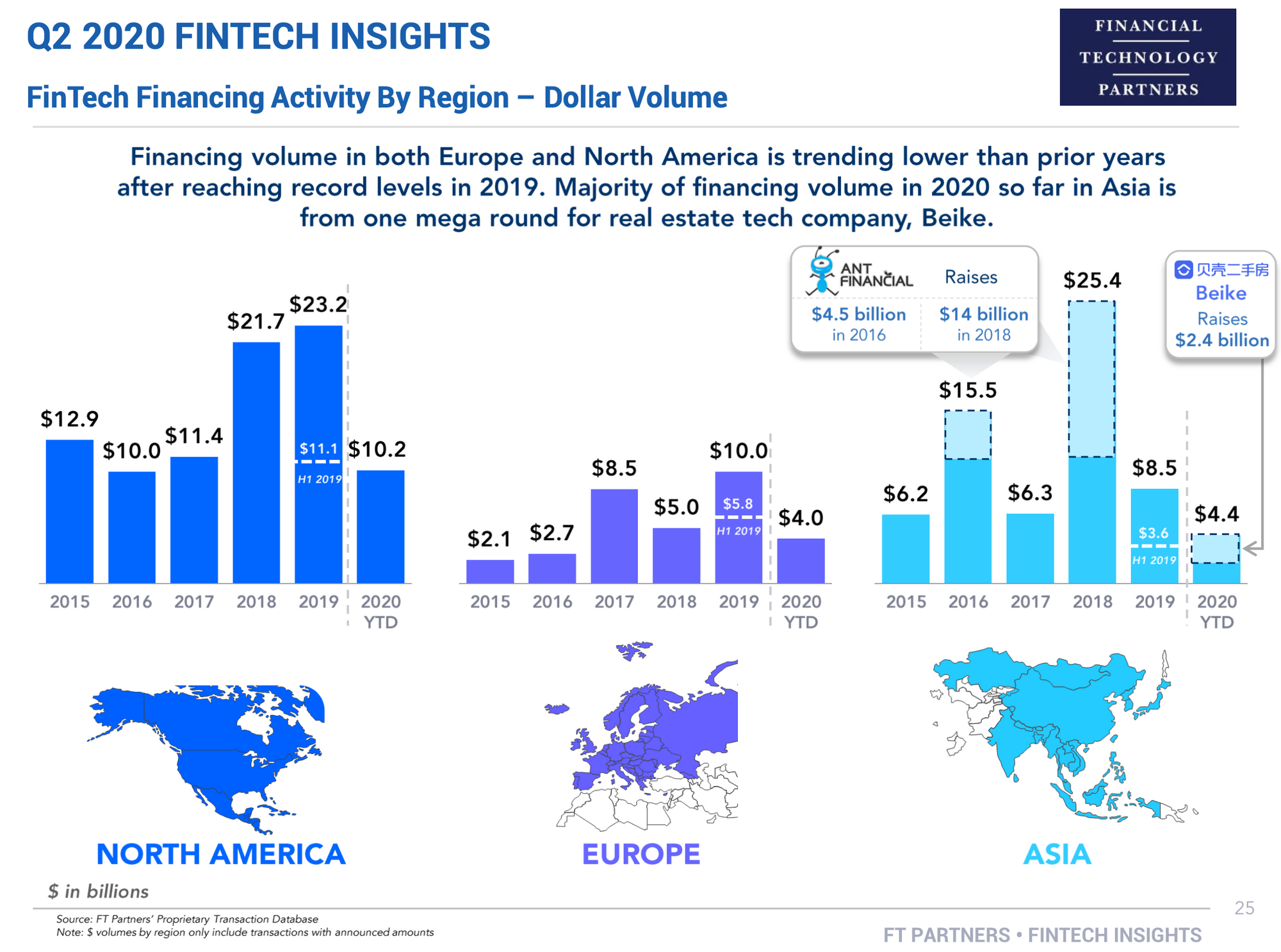

Q2 2020 Trends

Despite the recession-like set back caused by Covid-19 during the first half of 2020, trends show that capital continues to flow in major markets including Asia. The following chart excerpted from FT Partners Q2 2020 fintech report highlights this trend:

Product complexity mirrors a complex consumer

In the last decade that just ended in 2020, low-interest rates helped give rise to alternative investments such as non-bank products, and cryptocurrencies after bitcoin emerged from the ashes (in 2008) of the last financial crisis.

Furthermore, clients are becoming more sophisticated and aware of global events, whether geo-political, such as protests in Hong Kong or uncertainty with Brexit, or even Presidential impeachment inquiries. News travels faster than ever, and brokers are helping enable traders to react more quickly with the right tools and products.

New Brokerage Products

Even without crypto, fintech continues to get more complicated as personalization reaches new levels thanks to new computer-driven math and A.I. algorithms.

Retail margin-based trading continues to dominate across stockbrokers and forex brokers globally, whether offering underlying markets, or contracts for difference (CFDs), new products and markets continue to appear.

· Examples include exchange-traded futures, Turbo's, options, and certificates, ETFs, and off-exchange options, custom CFD indices, with themes spanning agricultural(Cannabis) to high-technology (blockchain).

Forex Brokers and Stock Brokers have been at the forefront of these innovations that affect traders and investors globally.

Democratic finance

Crowdfunding has also risen to become a more democratic process with easier access for retail investors to participate in funding rounds.

· Previously only available to qualified or high-net-worth investors, and Venture Capital firms (V.C.s), retail traders have been buying equity in private companies and helping to finance their debt, in return for interest and potential convertible rights.

In these cases, users demand easy access to all material information and data transparently, to expedite their due diligence and decision making.

The best brokers give traders the tools they need to access the information they need to make the right decision while being fully informed.

Pace for the distance not speed

The best technology companies are often widely used and have known reputations for their brands but didn’t get there overnight.

For brokers, it is a long-term game. You cannot expect to enter the brokerage space and win after just a few short years unless your firm is one of the few lucky startups or companies with real innovation that can obtain such high growth organically and year-over-year in a sustainable way (of course, that's what everyone wants, but it's not that easy).

Perfection leaves clues

The best brokers will have lasting qualities, which are the result of decades of experience, trial and error, and millions of dollars of research and development spending.

· Brokerage services can have many things in common, whether offered by a trusted publicly-traded company, bank, or a private start-up.

While many of the significant major innovations in fintech has been driven by the payments industry, the online brokerage industry has also steadily evolved to meet the needs of highly demanding traders and investors, regardless of their location and spoken language.

Valid for Asia and the rest of the world

The things in common that all successful brokers have are right, whether you are in Asia, Europe, the Americas, or nearly anywhere else in the world, plus or minus a few cultural differences.

In other words, when we put traditions and cultural expectations aside, all successful brokers have specific qualities that help them perfect their offerings.

Below is an example of categories, not meant to be exhaustive but cover all the main themes to keep in mind when building the perfect broker in Asia:

Efficient organizational structure: Larger companies will usually have more complex structures to protect themselves in terms of resiliency against either legal actions or regulatory actions from government bodies(such as where each entity is legally domiciled, the company type, and ownership structure, etc...)

Proper Regulatory statuses: depending on the jurisdiction it is operating from and where it will solicit clients, a broker should not only obtain statuses in multiple financial hubs but also demonstrate compliance with high integrity, to maintain client’s trust and a good reputation.

· Brokers shouldn’t assume that by obtaining a license in a particular jurisdiction that they will automatically win everyone’s trust.

Regulatory licenses help maintain trust and increase trust that is already established on a strong organizational structure.

Compliance and Trust: A firm should not acquire a license if it is not ready to take on all the responsibility of being a regulated firm, and thus should not launch its brokerage services.

· Going the un-regulated route is not recommended either, as the potential for fraud and regulatory actions not only put the founders and staff at risk but the consumers too.

· At the minimum, the firm should be a member of a competent self-regulatory organization (SRO).

The best brokers understand that proper regulation in numerous countries requires time, money,and hard work.

Offering of Investments: The range and number of available asset classes across all the tradable symbols that traders will be able to access from the brokerage.

· Whether 10,000 markets are available or 300, this is a relevant category that factors into other areas.

The best brokers usually offer thousands of tradable symbols spanning multiple asset classes and markets.

Commissions & Fees: The trading costs and any other fees such as commissions, spreads and financing/cost-of-carry interest rates, and how they may vary by account type and trading platform is an essential part of a broker's competitive edge. The best brokers will have the right balance of everything for nearly everyone.

Trading platforms: Whether a broker offers a desktop-based and or a web-based trading platform, usually, a firm should provide at least both, and often there will be multiple platforms available, with support for advanced charting, various tools, algorithmic trading and or social copy-trading.

Mobile apps: The best forex brokers in Asia need amazing mobile applications. Beyond a pretty design and smooth UX, the features in the U.I. must meet a trader's needs and should closely resemble their web or desktop counterparts offered by the broker to provide a consistent experience across devices.

· The app should be rich with features but not overly complicated and burdensome to users.

The best brokers made it super easy to use their mobile app, and they pack a ton of features into,by continually revising and improving the UX as the U.I. is enhanced.

Research and Education: This category has evolved in recent years to extend beyond just a few headlines and a daily blog update with market analysis, and a few educational articles and an e-book.

· The best brokers will have not just numerous sources for headlines and a variety of reports; they, will organize them very well for traders to consume and even make it easier to act on such content when it comes to trading.

Other types of media that the best brokers offer include social or TV-style interviews and streaming videos, and interactive content. The same can be said for educational content. Then there are trading signals, automated patterns, and user-generated social copy-trading solutions.

Customer Service: This category is challenging as the way a customer service representative handles themselves at a broker, is mostly influenced by how that broker trains and instructs the representatives to do their jobs.

· The level of information on a broker's site can impact their client services, such as the extent of FAQs and how clients are directed to such resources.

In other words, one rep might give a canned response and sound like they are reading off a script. In contrast, a more skillful representative will make the customer feel like they are getting the personalized support they deserve, even if they are speaking with A.I. robot that authenticates with their voice.

The best brokers for customer service will almost always go above and beyond to accommodate and anticipate the client's needs when it comes to supporting inquiries and while enhancing client relationships.

Culture and language matter too

Of course, as you will hear on almost any panel, it’s also critically important to understand the local markets that a broker operates in, and ensure that your website content is natively written/translated.

I would take that a step further and say that the local language spoken by the customers should also be spoken not just by the broker's support team but across the management or C-Suite, to have a real impact and the chance to perfect the brokerage offering locally.

Local operations and fluent/native executives

Brokers that don’t wish to operate in a country but will still solicit there also run risks from a potential regulatory side, yet will be at a further disadvantage when it comes to not having a local presence, including local staff and management.

· The solution is to invest from the top down by hiring an executive with local expertise, ideally a native speaker, or at least fluent with profound local knowledge and industry resources.

And then build up the operations from that perspective with the local CEO taking responsibility but guided by the board and global CEO, for example.

Brokers must be excellent in all areas to be the best

Brokers must excel across every category that is important to customers. There need to be abundant options for all the essential categories mentioned in this article, for example.

Usually, the more of these "stand-out" features a broker has, the more they can really make a first lasting impression on potential customers, whether during an initial interaction online or when demonstrating the broker’s trading software applications during a free trial version.

New and existing market share

Given that all brokers are competing for either existing or new market entrants (i.e., existing traders out there, or people new to trading that will try it for the first time), it is crucial to understand the various trading demographics you will focus on and make sure to cater to all of them well.

· A boutique firm might be appealing for one quality but severely lacking in other areas, creating an imbalance.

The best brokers are open to nearly everyone, can scale, and have capital and resources to continually improve their services.

Growth and risk factors

Every broker wants to win more customers. Yet, with exponential growth, there are also exponential risk factors, and taking on more risk for a broker can translate to more risk for clients. Whether a broker is spending on marketing or doing organic keyword research to optimize search engine results, management decisions should be backed by high-quality and accurate data.

· Private brokerage companies should report almost as much as they would if they were public when it comes to information that consumers would want to know regarding the state of operations at the firm.

The best brokers communicate these data points very well and unambiguously.

Transparency, best-practices, and leadership

Governance, ethics, and company culture are at the heart of this management challenge and affect how customers are also managed whether directly through support or in the form of innovation or the lack thereof in the trading applications.

· The mission statement/brand ethos of the firm should be a key driver and must be a compelling story that inspires others and shines through the company's products and services.

That type of market leadership can result in the difference between a good platform and an excellent one.

Failure: Iterate or don't lie

The best brokers will also fail often yet quickly learn and implement feedback to iterate their products in a highly-controlled manner, while the worst firms will try to hide their failures or even worse try to masquerade a lousy product as being the best of its kind, oblivious to the reality of the marketplace.

The PR team must be aligned with the management and product development realities along with all other key department heads, including client relations and marketing, so the messaging is honest and consistent internally and externally to the public.

Leading the industry forward

The market doesn’t lie, so over time, the industry will follow the most successful trends, and these are the categories where a broker's offering can be perfected.

When a broker stops improving in any category, there are dozens of others quickly catching up. There is no plateau for progress; brokers are continually growing, or if not, they are declining.

It's the Journey, not the destination that matters

Just like trading, it's not enough to win on one good trade; it's what you do most of the time(on average) that matters.

· Perfection is not a destination to arrive at, but rather a quality that must be continually strived for.

I hope that this article helps you and your potential brokerage or related business strive to perfection and that your actions on average will help the collective to lead others in the industry forward so everyone benefits long term.

Author: Steven Hatzakis, Global Director of Research, Forex & Crypto at ForexBrokers