Due to potential changes of regulation in Australia, and the existing effect of ESMA’s leverage restrictions in Europe, FX and CFD brokers are reviewing other jurisdictions for potential homes to part of their business. One Asian country that is currently getting interest from brokers is Singapore.

CFD brokers aren’t new to Singapore, with a growing list of large global brokers as CMC Markets, Plus500 and Phillip Capital already being licensed there under the country’s financial regulator, the Monetary Authority of Singapore (MAS).

The appeal of Singapore includes its proximity to the rest of Asia such as China, Malaysia and India, multi-lingual workforce, being an existing hub of institutional FX and reputable regulation under the MAS.

MAS OTC Derivative Reporting

But, before setting up in Singapore, one item to consider are new requirements of daily OTC derivative reporting to the MAS. Put into effect in 2016, the regulation entered its second phase in October 2019 which increased the number of fields being reported as well as widening the scope of firms falling under the regulation.

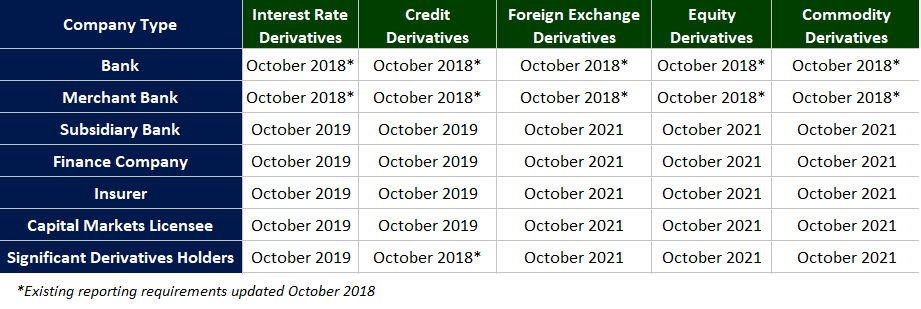

After focusing on holders of Bank and Merchant Bank licenses, MAS OTC derivative reporting was expanded last year. The regulation now includes certain Capital Markets, Finance Company, Insurance and Subsidiary Bank license holders of which CFD brokers fall under.

The regulation is similar to that of EMIR in the EU and UK and derivative reporting requirements under ASIC. As such, derivative trades for Interest Rate, FX, Credit, Equity and Commodity asset classes need to be reported to a licensed Trade Repository (currently on the DTCC) in T+2 basis.

The reports include information about counterparties, product information and trade details. Brokers will find that the majority of the data needed to report is available in their MT4, Bridge Provider systems or trading platform reports.

Exemptions for ETDs, Retail Trading and who need to report

One notable difference between reporting under MAS and other jurisdictions are several exemptions that exist in the regulation.

• ETD – The regulation only requires OTC derivatives to be reported with Exchange Traded Derivatives (ETDs) being out of scope. This is an important exemption as ETDs are often more difficult to report than OTC products, with the only multimillion-dollar EMIR fine as of the end of 2019 being related to errors in ETD reporting.

• Retail – Under scope for MAS are any OTC derivatives which include CFDs and FX. However, the regulation exempts trades with retail counterparties. For many CFD brokers, this will either greater limit the number of trades that they need to report or exempt them altogether. ***

• Minimum trading thresholds – The regulation also includes exemptions for firms that don’t meet minimum thresholds for assets under management and amounts traded. For CFD brokers, this exempts firms that have less than SGD$ 5 billion in annual trades with accredited investors and institutions.

*** Worth noting is that the exemption doesn’t cover STP hedging of retail flow with intra-group entities or external entities. Therefore, STP brokers who are hedging over $SGD 5 billion in trades with an institutional entity are required to report those legs of the trade to the MAS.

Phase 2 of FX starts October 2021

Another key point for CFD brokers is that their reporting obligation for FX, Equity and Commodity trades only begins in October 2021 (this go-live date had previously been set for October 2020 but was postponed for a year as part of a larger COVID-19 easing of regulation by the MAS). As these asset classes compose the vast majority of products traded by CFD brokers, many of them didn’t fall under scope when the October 2019 obligations of Phase 2 for Credit and Interest Rate products began (see table below).

The author is Regulation Subject Matter Expert at Cappitech, a fintech firm that automates regulatory transaction reporting for MAS, EMIR, MIFIR, ASIC and other jurisdictions around the globe.

Author: Ron Finberg - Regulation Subject Matter Expert