The Generation Game

Introduction

No one could have predicted the effect COVID-19 would have on the world or will have in the future. It would be a brave prediction to say that at some point the world will return to “normal” - more likely we will fondly remember how we were before Coronavirus and how the new normal is. Depending on where you were, the signs of something extraordinary began to spread out from Asia in December 2019 and January 2020; by March 2020 the pandemic had gripped us all. Where many sectors shut down and went into economic hardships, others like Food, Deliveries, and Online Financial Trading boomed. Along the way, we learned some valuable lessons to carry into whatever the future holds.

Being independent means that not only do I see trends across the industry but across industries both B2B and B2C. Many themes are reoccurring. Even before COVID-19, the costs of Marketing were rising to almost prohibitive levels for acquisition. Regular channels such as Google and Facebook, in particular, are growing more expensive. Audiences and Keyword bidding have become more complex since Google released the Bert update. One thing Coronavirus brought the industry was a wider depth in the number of keywords to bid on.

Add to these restrictions that Google and Facebook place on certain industries and Governments becoming wary and restricting advertising channels, and not only are costs rising but distribution channels are narrowing. Combine this with a rise in the use of banner blockers and it paints a difficult picture. For the purposes of keeping just to Marketing, we will not touch issues with compliance, KYC, bonus restrictions, and payments.

I have seen that no matter the restrictions, the fact that it is a level playing field means that, at least everyone adapts and life goes on. One need only look at the Tobacco Industry.

Where the Financial Sector is lagging behind other industries is both in the pace of change necessary and the understanding of the Millennial and Generation Z (or Post Millennial) markets and how to react.

Understanding the Driving Force

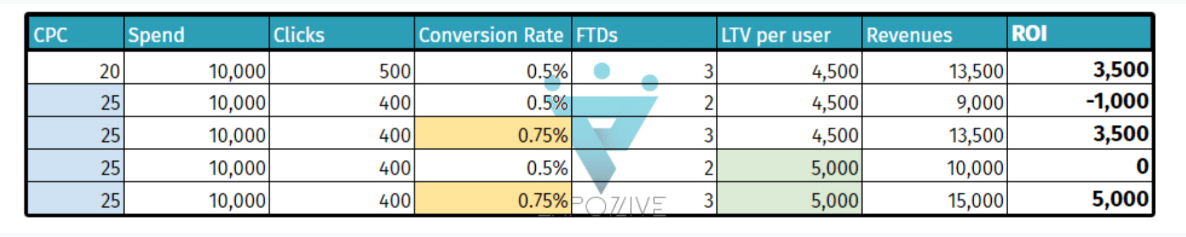

Before seeing how to solve the issues, we need to understand what are the driving forces behind the industry - the chain. It starts with B2C or Retail Brokers - their growth fuels demand Services and Technologies. For the B2C side to grow we need to examine what is within control and what variables can offset them. The key is to improve conversion rates at every point along the customer journey. If the initial cost to attract visitors is beyond our control, we need to increase the percentage of quality visitors making a registration, then the percentage of registrations to the first deposit, first to second deposit, lifetime value, and length. The keyword here is “quality”. We can offset some costs by optimization, but we must work on engaging visitors with real intention to buy.

B2B companies could just blame a slow industry for seeing a shrinkage in their business, or they could learn to understand the problems their clients and potential clients face and include solutions that help them grow. For example, including Marketing Automation tools, Marketing Channels, better Analytical tools, Banner Servers, comparison or industry reports, consulting services, and so on.

Both sides suffer from an inability to create differentiation in the market. Specific to Finance, platforms are a commodity, with there being little way to differentiate. Even without restrictions on Bonuses and Leverage, offers also are very similar. If the late 2010s saw a rush of brokers offering Trading Tools, Signals, Trading Schools and other value add offers - the question is if this has really been effective or the way to go as we enter the 2020’s?

We are also seeing the age of the Millennials, as they come of age and disposable income while bringing their culture and their way of life to the Market. Sure, Marketing Experts will tell you it is all about Experiential Marketing, but this is just a buzzword. The real trick is understanding what this means and how it can be applied.

In short, we are entering a decade with major challenges. Not least of which are: understanding how to reach our audiences, and, what to tell them.

In or Out or Both?

One of the biggest shifts in the last few years of the decade has seen brokers bring more Marketing in-house while widening their Marketing mix, something that other sectors such as iGaming have been doing for more than a decade.

Running a wide field of activities requires focus, expertise, and coordination. Each silo of activity not only needs to convey the same messages, propositions, and language but also assist each other in gaining better results. For example, Content Marketing helps Search Engine Optimization (SEO) directly, but it also assists results in Search Engine Marketing (SEM) by improving conversion rates on paid advertising. There is a need to make sure the same keywords and phrases are being targeted by both SEO and SEM so that ads appear on a page where the company is also ranked, and that the technical structure and webpages are correctly set up to be read by web crawlers, and that when shared on Social Media, the correct title and image are shown.

For some activities, it is cost-effective to hire in expertise, such as SEO and SEM. Other areas are less cost-effective or have limited expertise in the marketplace. Social Media is a prime example. Firstly, in most cases, the time required is not full time, and therefore either the activities are added to existing responsibilities of someone in the company (usually the Content Editor) who is less well equipped or experienced to optimize the activity or outsourced. Why? Do you know if Twitter is important? How many posts should there be daily and why? How do you gain Twitter Followers? What are the limitations of Followed to Followers? Do you need Twitch or TikTok? How does Social Media contribute to Sales? If you are B2B, how do you use LinkedIn for cold outreach programs? What results should you expect?

This is just the first part of the funnel. There is a need to convert visits to accounts and accounts for deposits. With rising acquisition costs, you need to retain your customers for longer and for them to spend more to return your investment.

One of the main trends we are already seeing is a move to a “hybrid” consulting. This is taking external expertise on a limited number of hours to either help coordinate activities or at least build the strategy, assistance in building a brand identity, or taking over, complementing or supplementing some activities.

AI, Automation and Smart Practices

One other area we are seeing for assistance from external experts is on setting up Marketing Automation, building funnels/trees, and directing the correct messages via the correct channels at the correct time. This is an area that needs expert attention not just in set up but in optimization both inflows and in the messaging. If I got a Euro for every time I heard: “We got this automation tool but I don’t know or see how it helps” or something along those lines, my account would be a very happy person. Taking on AI and Automation without investing in the implementation is like buying a Lamborghini with a Learner’s License - expensive and wasted. You do not just need to learn to drive, but you need advanced driving courses and practice to get the most out of the purchase.

One of the biggest challenges facing the industry as we enter 2020 is trying to break out of old bad habits. As little as just a few years ago, the industry was fueled by affiliate traffic that was converted via hard sell telephone calls. Already affiliate traffic has decreased to a healthier 30% of the Marketing Mix with many activities being taken in-house. The bigger issue is that the industry has never focussed enough time in the Retention and Growth of existing customers because of the large number of resources that need to be pumped into telesales.

Already there are numerous systems available to add AI and Automation and lessen the burden while increasing the productivity and results of sales desks. This should mean that reach can be increased and retention activities can get much more focus. With proper implementation and optimization agents should only be speaking with people who have a high probability of making a first or subsequent deposit, and just need that final push by a human. And, it should be a constant and steady stream - on-call ends and another begins with a click (no dialling required).

Millennials and Gen Z on demand

It seems bizarre to explain about this sector to the Finance Industry when it has one of the highest concentrations of Millennials in Founder or Senior positions! This has become one of the hottest topics across the vast majority of industries. It seems to take up just as many articles, debates, and research as AI does; and rightly so! This is “the” emerging market, coming to their prime. The issue is that they behave, think, and are triggered vastly different from previous generations.

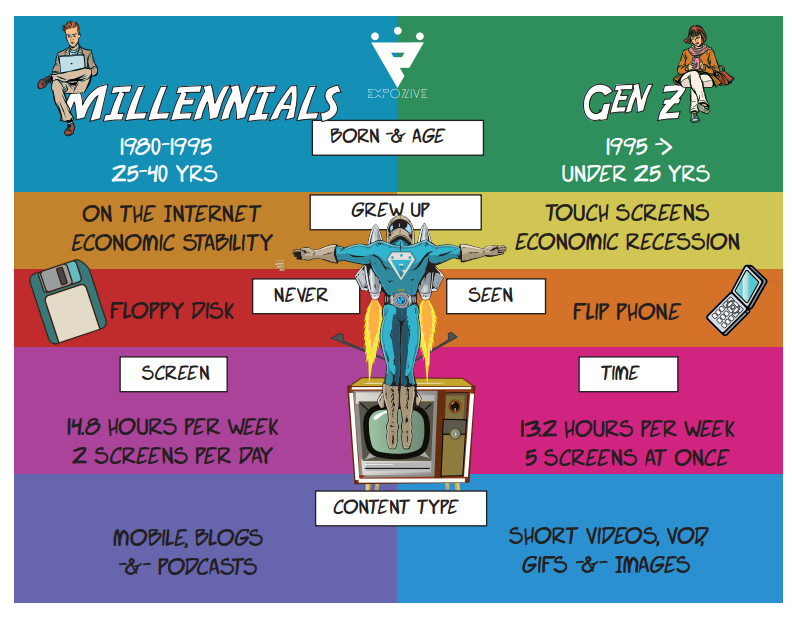

For the interest of clarity - let’s define the groups. Millennials were born between 1985 and 1995, placing them in the 25 to 40 years age range. The older Millennials are certainly reaching the age of financial independence and disposable income. The younger ones share more with the younger Generation Z or Post Millennials who were born after 1995. This makes those born before the start of the Millenium aged between 19 to 25 years old. Because their behaviour and triggers are so different from Millennials, it is impossible not to start looking at them and building up towards their needs as well. With more and more young people living with parents until later and later ages, surprisingly there is some disposable income and entertainment/investment budget in this group.

Bear in mind, both generations have grown up online. Millennials grew up with PCs and Gen Z with touch screens. Their social interaction, consumerism, and culture are based on an online world. Couple this with the crippling costs of education and the unaffordable house pricing in most countries, we have a vastly different generation from their parents.

They go out less, with many reports citing closures of not just brick and mortar retail stores, but bars, clubs, and restaurants. This is a partial view - in the top 5 global companies sit Amazon and Apple. Millennials are brand aware.

Both generations have a reputation for respecting the money they have more, but, by the same token both generations are willing to spend their money. Apple for example is a premium brand with high relative prices. Their triggers are slightly different. Millennials look for perceived value for money, while Gen Z looks more at trust and peer recommendations. Both are looking for value in terms of an experience and something that challenges their skill and sense of competition - hence the buzz around Experiential Marketing.

One of the curious and positive side effects of global lockdowns is that it has shown all of us a view of the world through the eyes of Millennials and Gen Zs. Or the connection to the outside world was mostly online. Many of us were aware of possible personal financial concerns, more cautious in what to spend our money on, and who to trust. We all looked for some kind of value beyond the price tag, we wanted some kind of surrogate for real-life experiences and entertainment. In short - we all became younger, at least in our mindset. As businesses, we need to look at how we would attract ourselves during lockdown - what experience we can give our audience.

For some industries, this is easy to imagine. If you have a land-based casino, banks of slots and expensive table games just do not meet the grade. There is no skill challenge in the games and no experience to justify leaving the house or parting with money. If the focus was made to give an experience with entertainment, activities, competitions, and skill factors - this would be Experiential. For a Retail Financial Trading broker, creating an experience is a little harder to create an “Entertainment Experience”. Free trading tools and signals do not meet the brief.

If we revisit the triggers, trust and perceived value can be integrated into an offering that also gives a skill challenge and competition. It is food for thought.

When we talk about Marketing in general, we look at traditional advertising (such as TV), Digital Marketing (including Search Engines, Display & Social Media), Email/Messaging Marketing, Content Marketing, and Affiliate Marketing. All of these channels are relevant but need to be approached differently.

Take TV advertising as an example. In 2018, according to the Video Advertising Bureau (VAB), only 42% of Millennials watched scheduled programming and this number is in decline. Millennials consume 14.8 hours of TV weekly and Gen Z less at 13.2 hours per week. So, is TV advertising dead? They still watch TV programs, but they consume on-demand rather than on scheduled programming. Product placement has become a huge influence on consumer behaviour. With banner blockers and native advertising fatigue, TV and Radio have seen a renaissance in recent years. It seems a little counter-intuitive, there is some logic. Most channels have online on-demand services that you can segment. Many radio channels will include production as part of the advertising package and TV advertising production costs have become affordable.

With much of the program consumption online and on mobile, advertising has gone from the “ad break” to the holistic experience around the viewing. With YouTube, for example, there are video ads before the main clip. With the “Skip Ad” button, the way advertising is presented means a re-think in the scripting of video ads - you have only up to 3 or 5 seconds to grab the viewers’ attention and get your brand across.

This type of advertising consumption suits the Millennial modus operandi - they need a fast hook to grab attention. Once interested they are willing to invest their time and to make decisions, including buying decisions based on trust, value for money (not price), and the opinions of others.

An entire Influencer Marketing industry has grown, with stars endorsing products and services. Influencer Marketing in turn has turned Affiliate Marketing on its head. Micro-Influencers and Nano Influencers are becoming the new Affiliates and Digital Marketing channels of Generation Z.

Building Brand Awareness is key. Build an appealing proposition, and get the message out far and wide. Content and Video Marketing are key, as is Social Media and Social Proof on the right channels with strong communities and followers. Your Brand needs to be open, honest, caring, and human. Bad experience stories spread fast but are forgiven just as fast of dealt with honestly, quickly, and in a human caring way. Standard and user reviews are dead. Most people distrust these and consider most reviews fake. Take time to search for “The Shed Restaurant” on YouTube as a good example of how reviews can be manipulated.

Takeaways

There will always be increasing competition and restrictions, be it from advertising channels or regulators. Costs for consumers reduce while costs for suppliers rise. Marketing will always evolve and become more complex. Target markets will always be fluid. All these factors are a level playing field for everyone. The key is how you meet the challenges.

As we enter the post-COVID-19 world, the rates of change and complexity will continue to become faster and faster. Marketing will need to become more sophisticated and complex touching on customer experience, sales, and even Human Resources. Companies will need to evaluate and balance how to accomplish the widest range of activities with the most expertise possible.

Author: Nicc Lewis, CEO & Founder of Expozive Marketing & Marcom